Creative Funding for Japanese Films

The Film Series > Shochiku Animation > Film Funding > Toei Animation > Film Commission > Tokyo Fest 2006

When the Captain's loan collector enters the Newsroom, the tactics typically used are very imaginative: calm coercion, a swung crowbar, and threats upon his favorite hostess. The Captain has seen them all and subsequently developed a perfectly logical stall tactic for each - well, except for the crowbar.

Raising money to fund Japanese film projects has been getting equally creative in recent years. Take a peek at the Captain's latest entry to find out just how.

Raising money to fund Japanese film projects has been getting equally creative in recent years. Take a peek at the Captain's latest entry to find out just how.

It has been a head-scratching past 12 months for Japanese film investors.

September saw the opening of "Shinobi" (Heart Under Blade), an experiment in film funding that allowed the general public to purchase shares in this expensive, for Japan, $13.6 million ninja picture by studio Shochiku.

Share sales for the project began last December, fresh on the heels of Kadokawa Herald Pictures' establishment of the "Japan Film Fund" - a pool of money collected from a variety of investors to fund Kadokawa's bigger-budgeted films.

Japan's film companies are today racking up larger production costs - well in excess of the typical $2 million to $3 million - in an effort to keep up with imports. As a result, raising cash is getting more creative and deviating from the standard multi-partner funding model that usually includes only film-related companies.

"Until now, only companies or small groups of wealthy people were able to invest in the movie business," says Morito Ito, general manager for business development at Shochiku. "This is an opportunity for individuals to invest in something they admire."

The Shochiku scheme offered investors two options for investing in this romance epic starring heartthrobs Yukie Nakama and Joe Odagiri. For risk takers, there was the choice of placing 40% of equity in the film's performance with the remainder entering a bond-like guarantee. A more conservative approach offered punters a 10% and 90% breakdown. Minimum investment was set at 100,000 yen, or $909.

Shochiku's innovative idea worked. When the sale ended in February, the company managed to raise $4.54 million from 1,300 investors. Four stalwart investors alone ponied up over $90,900.

Shochiku's innovative idea worked. When the sale ended in February, the company managed to raise $4.54 million from 1,300 investors. Four stalwart investors alone ponied up over $90,900.

Rival Kadokawa's fund, for its part, has collected $31.8 million from seven companies, including Mizuho Bank and video game company Konami Corp., to produce films over the fund's seven-year period. Accumulated profits are returned to investors in a lump sum upon the fund's expiration.

The first was this year's $3 million "Chakushin Ari 2" (One Missed Call 2), a sequel to director Takashi Miike's tale of mobile-phone horror. This was followed by "Sengoku Jieitai 1549" (Samurai Commando: Mission 1549), a $10 million remake of the 1982 Mitsumasa Saito-directed sci-fi picture in which a military unit is sent back to the 16th century to face an army of samurai. Plans for the next picture featuring the mutated giant turtle "Gamera" are in the making.

Neither funding formula exactly follows common practice in Japan. It is standard to use the "production committee" approach, which collects investment funds from companies in such movie-related sectors as television, home video, and theater. Spreading risk upon multiple partners is a key benefit.

"In Japan, it is not as common for film production companies to get loans from banks as it is in the U.S.," says Yasushi Kotani, president of film-finance company Entertainment Farm. "If we don't use banks, we have to depend on investment by different means."

"In Japan, it is not as common for film production companies to get loans from banks as it is in the U.S.," says Yasushi Kotani, president of film-finance company Entertainment Farm. "If we don't use banks, we have to depend on investment by different means."

Entertainment Farm funds are providing partial financing to "J-Horror Theater," a series of six horror films released by Toho and produced by Taka Ichise, producer of the fright-filled blockbusters "Ringu" (The Ring) and "Juon" (Juon: The Grudge).

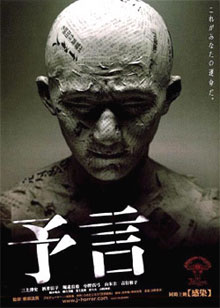

Last year's "Kansen" (Infection), the story of a decrepit hospital gripped by a spreading virus, and "Yogen" (Premonition), a tale of a newspaper printing stories of grisly events before they happen, were the first two films in this series.

Like Kadokawa's fund, Entertainment Farm funds include non-film related investors. Key players have been mobile content provider Index Corp. and commercials production company Dentsu Tec.

Despite its advantages, the investor-soup approach does have its downsides, Kotani says, one being that it is difficult to coordinate the direction of the project.

"In Hollywood producers have pretty good control over the project," he explains. "But when there are so many companies involved, each has a different opinion on what to do. For example, the theatrical distribution partner cares most about the theatrical distribution."

Kadokawa's fund, which is 100% owned by Kadokawa, hopes it will alleviate this problem by taking control of copyrights upon the conclusion of the fund's seven-year cycle, a contrast to the standard project-committee formula where they are jointly owned by the participants for typically 70 years.

Kadokawa's fund, which is 100% owned by Kadokawa, hopes it will alleviate this problem by taking control of copyrights upon the conclusion of the fund's seven-year cycle, a contrast to the standard project-committee formula where they are jointly owned by the participants for typically 70 years.

Shoji Udagawa, vice president of Kadokawa's international division, says that having the option of selling the rights upon expiration will keep investors in line. "All investors must work together over the project's course to ensure that it is a success," he says. "So if there is a problem with, for example, Konami, who is concerned with the game and merchandising rights, we could approach competitors Bandai or Sega."

Udagawa expects Kadokawa to offer similar funding ventures in the future if this maiden fund proves successful.

Shochiku, meanwhile, already has plans to sell shares in two additional upcoming movies.

"The film industry in Japan has great expectations for this new market in film funding," says Ito. "We hope that 'Shinobi' will be the starting point."

Note: A similar version of this article ran in Variety on October 17th as a part of a package on the Tokyo International Film Festival and Kadokawa's 60th anniversary.

The Film Series > Shochiku Animation > Film Funding > Toei Animation > Film Commission > Tokyo Fest 2006